what is the inheritance tax rate in virginia

Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022. Inheritance taxes which are calculated based on who inherits the estate as opposed to the overall value of the estate are currently collected in the states of Iowa Kentucky Maryland Nebraska New Jersey and PennsylvaniaNotice that Maryland and New Jersey collect both state estate taxes and inheritance taxes.

Virginia Estate Tax Everything You Need To Know Smartasset

No estate tax or inheritance tax Washington.

. The top estate tax rate is 20 percent exemption threshold. As a result the. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012.

Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. Maryland is the only state to impose both. The full table of Rhode Island estate tax rates is available on the.

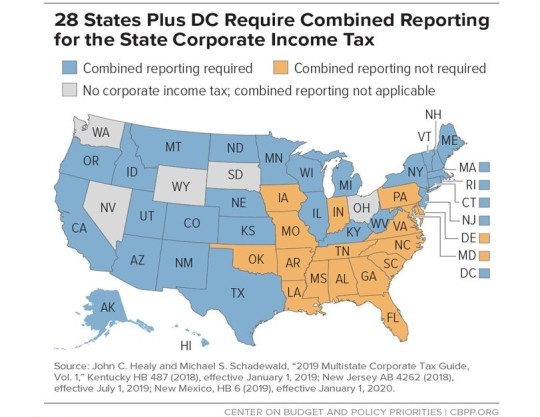

Twelve states and Washington DC. Impose estate taxes and six impose inheritance taxes. Today Virginia no longer has an estate tax or inheritance tax.

In contrast our tax burdens estimates allocate taxes to states that are economically affected by them. 2193 million Washington DC District of Columbia. Because tax collections represent a tally of tax payments made to state and local governments they measure legal incidence only.

And in. However certain remainder interests are still subject to the inheritance tax. Sales Tax Rate and Locality Code Lookup Sales Tax Rate and Locality Code Lookup If youre having trouble viewing or using the map below use the map here instead.

The distinction between tax burdens and tax collections is crucial to understanding tax shifting across state lines. A Liberal MP has denied he supports an inheritance tax despite reports he argued that people who inherit wealth are not paying tax in a stance at odds with his own partys position. On June 16 2021 the governor signed SF 619 which among other tax law changes reduces the inheritance tax rates by twenty percent each year beginning January 1 2021 through December 31 2024 and results in the repeal of the inheritance tax as of January 1 2025.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. State Inheritance Taxes. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Iowa has a separate inheritance tax on transfers to others than lineal ascendants and descendants. The top estate tax rate is 16 percent exemption threshold. A tax rate of 08 applies on amounts of at least 40000 but less than 90000 and tax rates increase sequentially from there.

With the elimination of the federal credit the Virginia estate tax was effectively repealed. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes.

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Average House Price Soars To A Record 250 000 House Prices Things To Sell House Purchasing

Virginia Estate Tax Lawyers Federal Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

Virginia Estate Tax Everything You Need To Know Smartasset

Subway Franchisees Are Fed Up With Megan Rapinoe S Tv Ads Tv Ads Tokyo Olympics Megan Rapinoe

Virginia Estate Tax Lawyers Federal Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Stubsondemand Online Paystub Generator Tool Company Finance Federal Income Tax Company Address

State Tax Proposals Would Make Virginia S Tax System More Fair The Commonwealth Institute The Commonwealth Institute

Virginia Estate Tax Everything You Need To Know Smartasset

Virginia Estate Tax Lawyers Federal Inheritance Taxes

Pin En Born In Blood Mafia Chronicles Cora Reilly

States With No Estate Tax Or Inheritance Tax Plan Where You Die

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Onl Inheritance Tax Estate Tax Nightlife Travel

The 10 Happiest States In America States In America Wyoming America